The pandemic will end someday. Whether you are traditionally published or indie, if you intend to make personal appearances at local bookstores, fairs, or conventions, you will have an inventory of books on hand to manage and account for at the end of the year. This can be quite a headache if you have more than one or two books to cart around with you.

But more importantly, even if you are traditionally published, you pay for the books you sell at shows.

But more importantly, even if you are traditionally published, you pay for the books you sell at shows.

The good businessperson has a spreadsheet of some sort to account for this side of the business, as it will be part of your annual business tax report. An excellent method for assembling the information you will generate for your tax report is discussed the previous post, The Business Sequence for Writers. Ellen King Rice has given us a great framework for keeping our business records straight.

There is only one more skill to have, and this is only for those who intend to sell books in person. A wise author understands that good records ensure a successful business and sets up the bookkeeping system before they go to book fairs. They have a list of the stock on hand, what books are on reorder, the day they were ordered, and how long it takes for them to ship. Also, you should keep an account of your cost for each book, both for tax purposes and insurance purposes, if the stock of books is lost or damaged in a house fire or flood.

You can do this on notebook paper with a pencil, a ruler, and a calculator. However, a green or yellow ledger book with eight to twelve columns is already set up for you to begin using.

I began working as a bookkeeper in 1982, using the industry-standard tools of the trade for the time. We noted each transaction with a red or black pencil in a green or yellow ledger book of varying sizes (2 to 32 columns). Then, we used rulers or yardsticks to ensure that we tracked a particular item on the correct line across all the columns. The handiest electronic device on my desk was the calculator with a printout tape.

The tools for this method of accounting are still available in the stationery section of any store and are quite affordable.

I use Excel for all my accounting purposes, but no matter how you create your spreadsheet, each title you have on hand to take to book fairs or shows has several costs associated with it. What follows are several screenshots of a simple way to organize a spreadsheet:

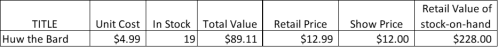

The first column contains the heading Titles: under that heading, list each book you take to shows by the title. We will use Huw the Bard as our example book.

On the same line as the title, working to the right in column 2, write unit cost. This is the price you pay for each copy you must take to a show and varies from title to title by the length of the book and the trim size. On the same line as the book’s title, write the cost you pay KDP or Ingram Sparks or your publisher for that book: $4.69

Column 3 is the current stock-on-hand at the end of the taxing quarter: Quantity in stock: 19

Column 4 is the sum of column three times column two: Inventory value: $89.11. That is what you would have to pay to replace those books. It is also what some Departments of Revenue may tax you on at the end of the year if the value of that stock is over a certain limit, say $5,000.00. My stock on hand never exceeds that limit.

This is why retail stores have end-of-the-year sales. They need to offload their inventory to keep their taxes low.

Column 5 is the retail price. This is what the book sells for at bookstores: $12.99. You set your retail price to cover the cost of replacing the book, with some revenue to cover table and vendor fees at shows and conventions, and still allow for a small profit.

Column 6 is the special show price (if you discount your books at shows): $12.00.

Column 7 is the retail value of your stock on hand. It is the sum of column 3 times column 6: $228.00.

Did you have to collect sales tax from your customers? When you apply for your business license, you will receive a pamphlet with all the taxing jurisdictions in your licensing area and their tax rates. These range between .08 and .11 here in Thurston County. Washington State has no income tax, so all our state’s revenues come from businesses and sales taxes collected at the time of purchase. Make a note of the city or county where the books were sold, as you may be required to forward the taxes collected to the Department of Revenue. If you are smart, you will make another page with these columns:

At the bottom of the page for both spreadsheets, total each column. That will give you the stock expenses for all your titles. There will be no scrambling at the end of the quarter for Business and Occupation taxes if you live in a state like Washington State or at the end of the year if you live elsewhere. Be smart and set the money collected as sales tax aside because it is not yours and shouldn’t be considered part of your income.

That way, you will have it at the end of the year if you only do a few shows a year like me, or quarterly if you are out there doing shows and signings every week.

The bookkeeping side of your business should take less than an hour after each show. If you have kept your spreadsheets updated, filling out annual business tax forms for your state and federal agencies will go quickly. You will have all the numbers you need to back up your reports if you are audited.

Also (and this is important), you will know the exact number of books you have on hand in each title. You will know when it’s time to reorder more stock. There is a two-to-three-week lag in printing and shipping time, so ordering books in advance is critical. You don’t want to waste money on stock you have plenty of, but you need to have a supply of your better sellers.

My personal spreadsheet is a little more detailed and is saved in the cloud as are all my business and other records. It looks like this:

Something we rarely consider is the random natural disaster, but we must be prepared. If something should happen to your stock of books due to theft, fire, or flood, you will be able to claim your business loss. Many authors are more prolific than I am. I have only 12 titles, including several anthologies that my work was published in. For most of us, replacing the stock of 1 to 30 titles is an expense that is difficult to carve out of the family budget unless we have sold enough to cover that cost.

Theft is rare, as people are usually quite decent at conventions and trade shows. I’ve only had one book stolen from a table at a show in all these years—a $15.00 (show cost) loss (or $6.80 my cost).

While it disturbed me on one level, I was a bit honored that someone wanted my book that badly. The experience left me confused as to how I was supposed to feel. But on the good side, it was nice to know that shoplifters are readers too!

Reblogged this on wordrefiner.

LikeLiked by 1 person

❤ Thank you, Mark!

LikeLike

Reblogged this on Kim's Musings.

LikeLiked by 1 person

Kim, Thank you for the reblog ❤

LikeLiked by 1 person

I can see the brilliance of your bookkeeping brain at work.

LikeLiked by 1 person

Hah! Thank you, Johanna ❤ Now I'll have to buy bigger hats for my fat head, lol!

LikeLike

Thank you for this. I will definitely make some changes to how I keep track at present!

LikeLiked by 1 person

Hello! I’m glad you found this system useful.

LikeLiked by 1 person

Such great info, Connie, but coming from you, I am not surprised! Thank you!

LikeLiked by 1 person

Hah! Now I’ve got a swollen ego but thank you for the compliment!

LikeLike